Methodology

Role of AI in Finance and Risk Management

- Time Series modelling and forecasting are at the core of quantitative analysis for most investors looking at Artificial Intelligence.

- Predicting markets however is challenging, perhaps impossible. Further, predicting markets even with a > 50% accuracy is not sufficient in real-life investing.

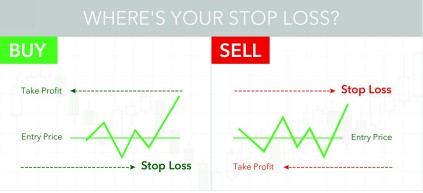

- Risk management, portfolio allocation, setting a stop loss, choosing underlying assets all contribute at least equally, but often dominate, the ‘prediction’ aspect of investment management.

- Setting on an investment strategy is always a decision on risk adjusted return.